En el artículo anterior hablamos sobre el transporte marítimo, su evolución, características y por qué es tan importante para el comercio internacional. Ya entendiendo la magnitud de este medio de transporte y todas las posibilidades que ofrece, el siguiente paso es aprender sobre el seguro de transporte marítimo, el cual se define como un contrato que tiene como objetivo indemnizar al asegurado los daños producidos a la mercancía por los riesgos ocurridos durante el trayecto marítimo.

Toda mercancía, en su proceso de entrega, es susceptible a todo tipo de riesgos o accidentes. Dentro de la lista de posibles incidentes marítimos están: robo, mojadura, oxidación, naufragio, avería gruesa, explosión, contaminación, incendio, maniobras de carga y descarga, entre otros. Esto puede generar grandes pérdidas económicas para todos los actores implicados en el proceso.

En 2017 la Agencia Europea de Seguridad Marítima (EMSA) publicó el Resumen Anual de Accidentes e Incidentes Marítimos, el cual consiste en un análisis profundo de los accidentes informados por los Estados miembros de la UE. Durante 2017 hubo un total de 3296 incidentes marítimos, 115 muertes reportadas, 976 heridos, 36 barcos perdidos y 125 investigaciones iniciadas.

Teniendo en cuenta estas cifras, es fundamental ir más allá de simplemente elegir el mejor empaque para los bienes y realizar un estudio riguroso para escoger el seguro de mercancía más adecuado a las necesidades de cada asegurado.

En este artículo encontrará información sobre el mundo de los seguros de transporte marítimo, desde sus orígenes hasta sus diferentes características.

1. La importancia del seguro de transporte marítimo a través del tiempo:

La necesidad del hombre de estar protegido ante los múltiples riesgos que enfrentaba en la navegación por el mar y los ríos dio lugar al seguro marítimo, también conocido como el primer seguro de transporte.

En la Antigua Grecia se crearon las bolsas de préstamos a la gruesa, un sistema en donde los comerciantes dueños de barcos conseguían préstamos para comprar mercancías y transportarlas por el mar para su venta. En la misma región, en la isla griega de Rodas, se creó la ley de Rodas, considerado como el primer código marítimo de la historia. Esta ley buscaba que las pérdidas ocasionadas por el arrojamiento de mercancía al mar fuera soportada por todos los interesados.

En 1687, el seguro de transporte marítimo tuvo una mayor importancia gracias a Lloyd’s Coffee House, una taberna en el muelle de Londres en donde se reunían comerciantes, capitanes de barcos y toda persona conocedora del negocio para hablar sobre incidentes en los viajes, contratar seguros de transporte y compartir conocimientos del negocio.

Más adelante, en el siglo XX, el mercado de seguros de transporte, que hasta ahora se limitaba al seguro marítimo, fue testigo de un cambio drástico gracias a los avances tecnológicos desarrollados. La mercancía comenzó a ser trasladada en otros medios de transporte como trenes, aviones y camiones y fue aquí cuando se empezó a implementar diferentes pólizas y seguros para cubrir los riesgos de cada tipo de transporte.

2. ¿Qué es la avería gruesa o común, simple o particular?

Dentro del Derecho Marítimo hay un término muy conocido y tradicional que se llama avería, el cual abarca todos los diferentes riesgos que desde siempre han afectado a la navegación marítima. Las averías están clasificadas en dos partes, las simples o particulares y las comunes o gruesas.

Avería gruesa o común:

Según el 347 de la Ley de Navegación Marítima, la avería gruesa se define actualmente como aquel acto en el cual, intencionada y razonablemente, se causa un daño o gasto extraordinario para la salvación común de los bienes comprometidos en un viaje marítimo en caso de estar todos amenazados por un peligro. También aclara que solo se reconocerá como avería gruesa cuando los daños o gastos sean consecuencia directa o previsible del acto de la avería.

Cuando se produce un acto de avería común, el capitán debe notificarlo en el libro oficial de navegación, indicando la fecha, hora y lugar del suceso, las razones y motivos de sus decisiones, así como las medidas tomadas sobre estos hechos.

Avería simple o particular:

Esta clase de avería se caracteriza porque, contrario a las gruesas o comunes, tienen un origen involuntario y sus daños o gastos recaen sobre quien los provoca.

Según la Ley de Navegación Marítima, la avería simple contempla tres casos; la arribada forzosa, que es cuando la embarcación llega a un punto distinto al de su destino; el naufragio, que es cuando se pierde o se hunde el buque en el mar; el abordaje, que es cuando hay una colisión entre buques, embarcaciones o artefactos navales, y resultan afectadas las personas o la mercancía.

Durante una situación de avería gruesa o simple, la solidaridad juega un papel muy importante. Por ejemplo, durante un encallamiento, situación en donde el buque queda inmovilizado entre rocas, bancos de arena, barreras de corales o hielo, el procedimiento a seguir es liberar peso mediante el sacrificio de la mercancía (arrojamiento de varios contenedores al azar). En estos casos todos los contenedores que iban en el buque son solidarios con las pérdidas de los otros. Para esto nombran a un comisario de averías, el cual mira todos los BL´s, el tipo de mercancía, entre otros datos de información.

Vale mencionar que todos los que transportaban mercancía en el buque deben ser solidarios, todo aquel que no participa en las pérdidas de los otros no se le entregará su respectiva mercancía. Por esta razón es importante tener asegurada la mercancía, porque en estos casos, el asegurado simplemente envía los documentos necesarios a su aseguradora y esta se encarga de cumplir con esa garantía.

3. El rol del bill of lading (B/L) en un contrato de seguro:

Actualmente, las Reglas de Hamburgo 1978 regulan el transporte marítimo internacional de mercancías. Según estas normas, el Bill of Lading (B/L) o “Conocimiento de Embarque” es un documento de transporte marítimo que informa sobre las mercancías en un buque y para probar la existencia de un contrato de transporte. También comprueba la recepción y las condiciones de la mercancía a bordo, al igual que el compromiso de entregar las mercancías en el puerto de destino indicado.

El B/L es muy importante para verificar que efectivamente la mercancía sí se aseguró a tiempo mediante el certificado de seguro. Es común ver casos en donde se asegura la mercancía cuando ya se ha presentado algún siniestro. Este documento permite a las aseguradoras constatar datos como la fecha que inició el viaje, el número de contenedor que le tocó a esa mercancía, el origen y el destino, el peso del contenedor, en otras palabras, todos los datos que se necesita para evidenciar que sí era la mercancía y no otra.

Al momento de un siniestro, el asegurado debe presentar el B/L, al igual que otros documentos, para hacer efectivo el certificado de seguro. Sin este documento, es muy difícil que lo indemnicen.

El Bill of Lading lo emite la empresa naviera o su agente y es firmado por el capitán del buque. Existen diferentes tipos de B/L de acuerdo a la forma en que se recibe la mercancía:

- Embarcado a bordo (shipped on board):

Se emite cuando se ha cargado la mercancía en el buque.

Limpio a bordo (clean on board): Se emite cuando la mercancía está en bodega y en buen estado.

Sucio a bordo (unclean on board): Se emite cuando hay observaciones sobre la mercancía. - Directo (straight):

Se emite cuando no hay escalas entre puerto de carga y puerto de descarga. La mercancía llega en el mismo buque en que fue embarcada.

- Mixto (combined):

Se emite cuando entre puerto de carga y puerto de descarga se deben hacer transbordos.

Como puede observar, el seguro de transporte marítimo ha ido evolucionando a través de los años y hoy en día juega un papel importante en los asuntos comerciales y económicos.

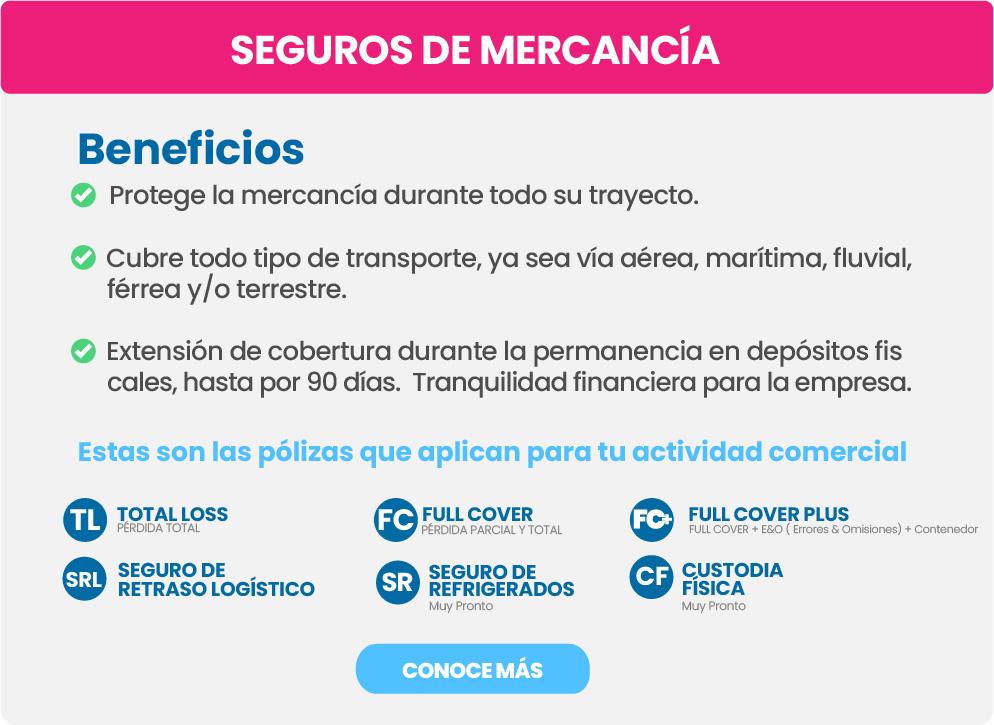

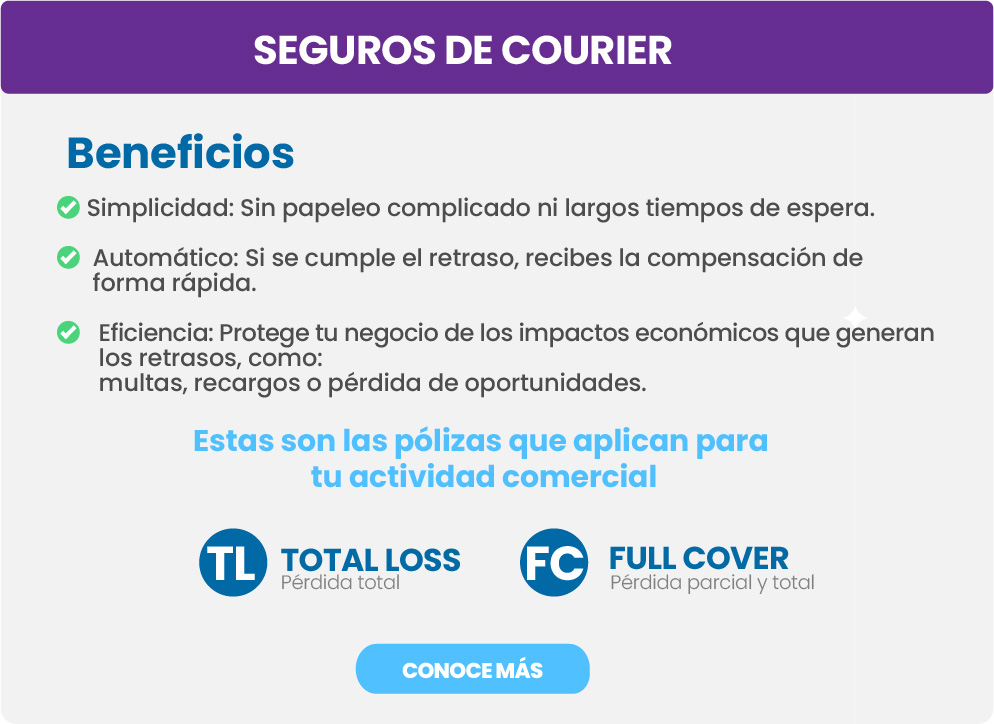

En JAH Insurance Brokers, le ofrecemos nuestro Seguro de Transporte de Mercancías para que asegure su patrimonio e inversión ante cualquier imprevisto. ¡Queremos ayudarle!